- Joined

- Jan 11, 2024

- Threads

- 40

- Messages

- 1,034

- Reaction score

- 1,579

- Location

- New Jersey, USA

- Vehicles

- 2025 Macan Turbo Electric

- Thread starter

- #1

Edit:

Explanation is in post 5 below.

--

Original post:

I got my Turbo on a 24mo one-pay lease as I've detailed in other threads.

Signed a check for $50k+ and in a couple of years, I can choose to keep the car (and pay $70k+) or return it at likely no cost.

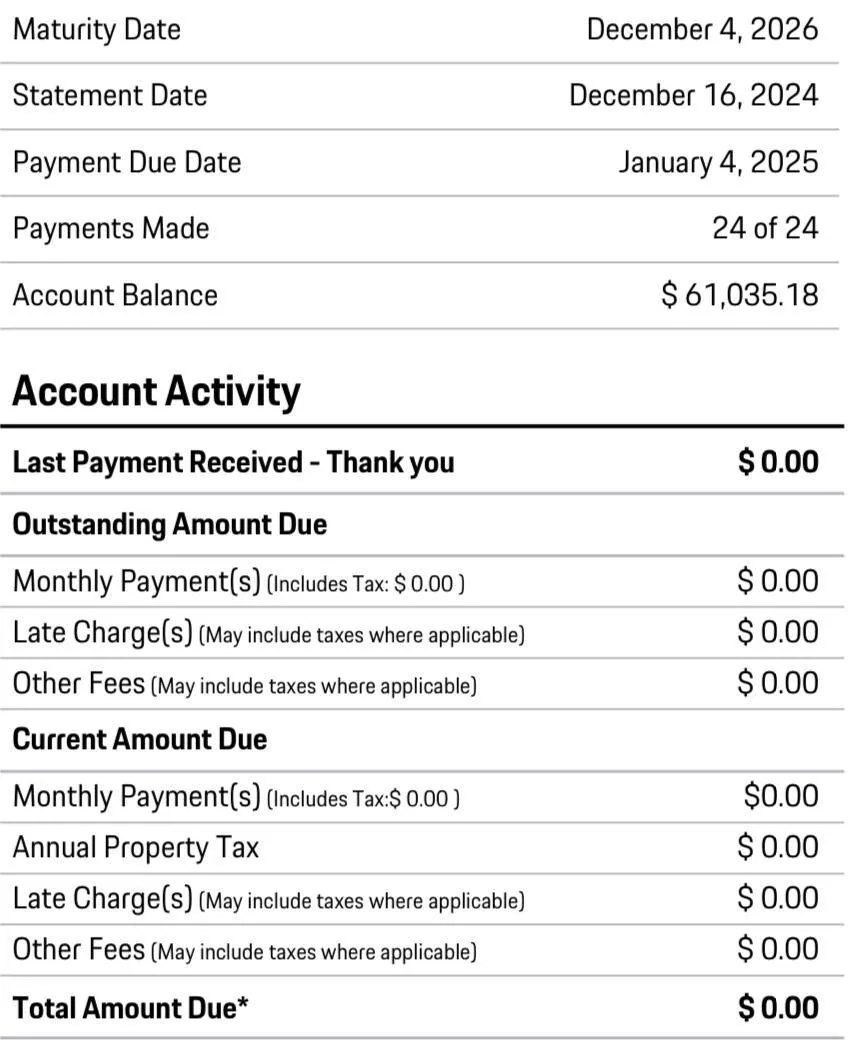

Looking at my first statement from PFS, I noticed the line that shows:

What is that? Can't be the balance left on the lease, paid it all upfront.

Is this what I have left to pay on the car if I were to buy it right away? If so, is that all in or is there anything else that gets added to it?

First time Porsche leaser and this may be a very stupid question... thanks!

Explanation is in post 5 below.

--

Original post:

I got my Turbo on a 24mo one-pay lease as I've detailed in other threads.

Signed a check for $50k+ and in a couple of years, I can choose to keep the car (and pay $70k+) or return it at likely no cost.

Looking at my first statement from PFS, I noticed the line that shows:

| Account Balance | $ 61,035.18 |

What is that? Can't be the balance left on the lease, paid it all upfront.

Is this what I have left to pay on the car if I were to buy it right away? If so, is that all in or is there anything else that gets added to it?

First time Porsche leaser and this may be a very stupid question... thanks!

Sponsored

Last edited: