- First Name

- Michael

- Joined

- Dec 18, 2024

- Threads

- 20

- Messages

- 246

- Reaction score

- 326

- Location

- Phoenix

- Vehicles

- Macan 4, Macan 4

Buried in the PFS lease terms is a small, but key fact that benefits PFS. The interest is computed using the actuarial method, not via simple interest. Many people often pay more or sooner to lower their principal balance, saving interest cost. That works with simple interest, but not under the actuarial method. Under the actuarial method, the “more or sooner” payments mostly go toward future interest, not principal, and so it doesn’t benefit the borrower. Under the actuarial method, pre-paying only works well for you when you pay off the loan completely. In that situation, you do get credit for paying early in the form of returned interest that was pre-computed as being owed by you. This is the formula cottony gave you in his post above, the interest savings you’d get by paying off completely and early.

https://www.federalreserve.gov/pubs/leasing/resource/different/early_exp5.htm

It’s unlikely with a single pay lease that you’d make a partial payment on the outstanding balance, but others reading this might.

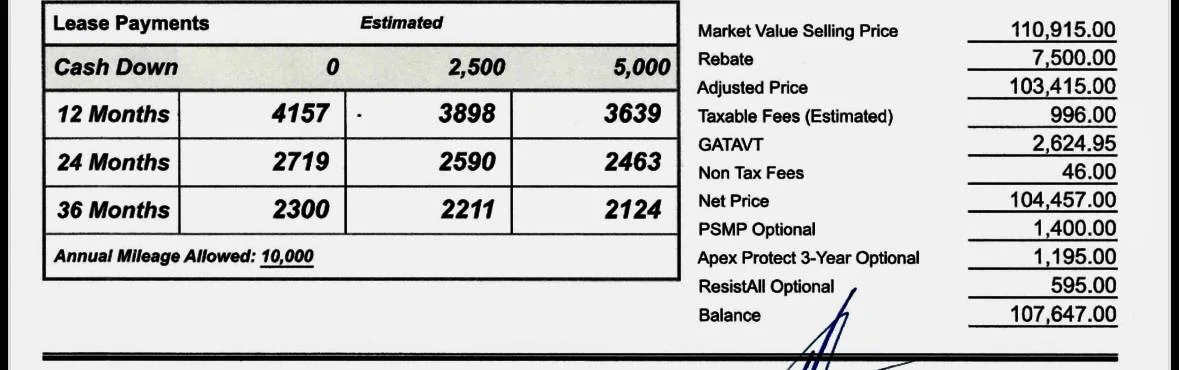

Also include in your savings the following: buying outright costs 118,000. Leasing Day 0 the payment is 45,300. Investing the difference of 72,700 at, say, 4% for three months gives you an interest income of $970 (less income taxes, if you really want to be exacting).

https://www.federalreserve.gov/pubs/leasing/resource/different/early_exp5.htm

It’s unlikely with a single pay lease that you’d make a partial payment on the outstanding balance, but others reading this might.

Also include in your savings the following: buying outright costs 118,000. Leasing Day 0 the payment is 45,300. Investing the difference of 72,700 at, say, 4% for three months gives you an interest income of $970 (less income taxes, if you really want to be exacting).

Sponsored

Last edited: