- Joined

- Jan 11, 2024

- Threads

- 40

- Messages

- 1,032

- Reaction score

- 1,574

- Location

- New Jersey, USA

- Vehicles

- 2025 Macan Turbo Electric

- Thread starter

- #1

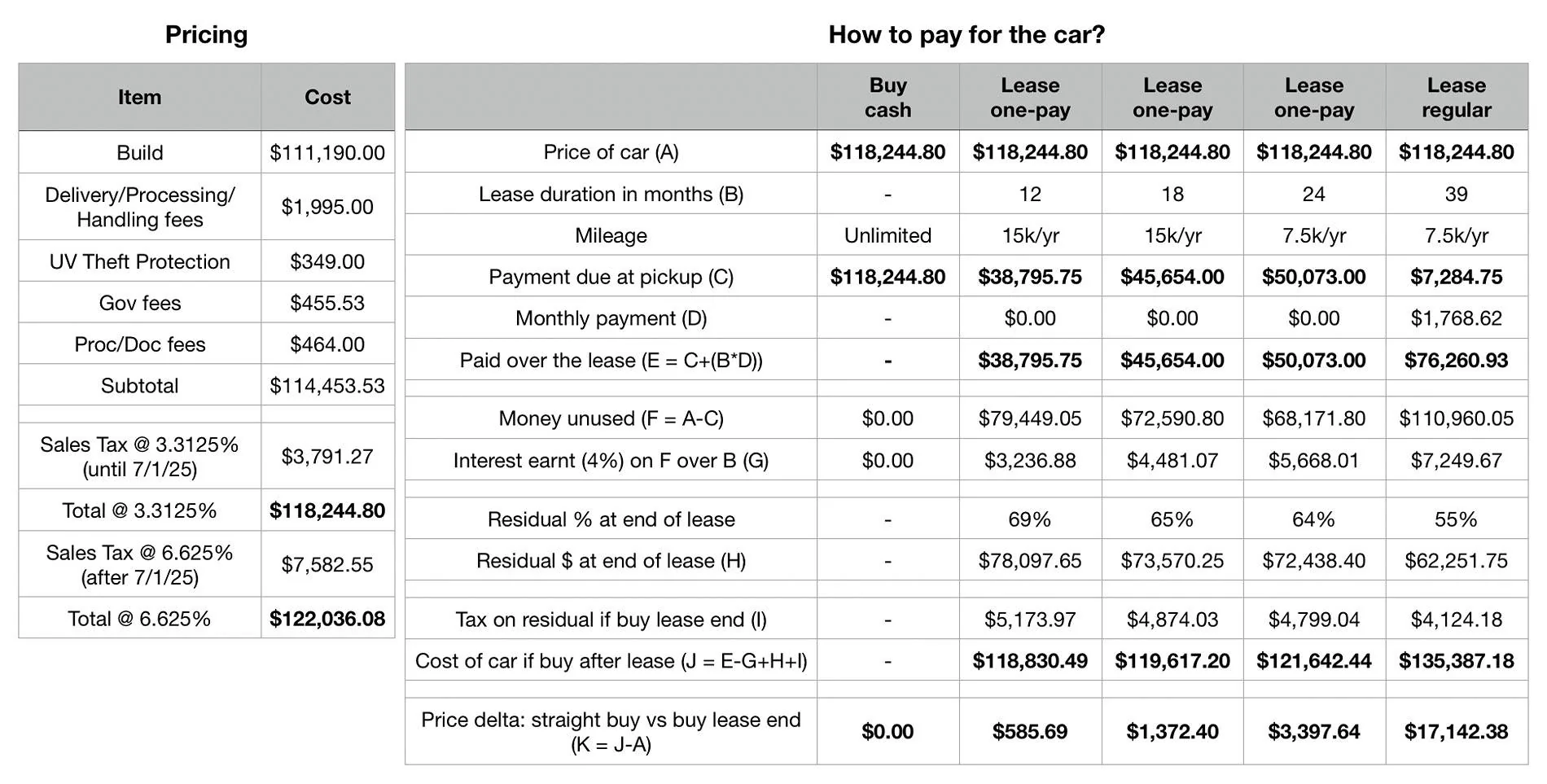

People keep saying “leasing gets you $7.5k credit, it’s amazing” and I have been very vocal (say here or here) about leases being a money suck, especially when wanting to purchase at lease end.

I always based my stance on the interests paid over the course of the lease but then came across the one-pay option.

Coupling that with a short lease can actually make sense (to my very “anti-lease” self).

Context:

The options:

I asked my SA to share all options with me and I’ve summarized the costs and options in the charts below.

Couple notes on the math:

My thoughts:

If conditions are favorable, I can just buy it then - and still sell it after 39 (or x) months of ownership when something better comes along.

If conditions suck, I can just walk away after 18/24 months.

Did I miss something? Not consider any aspect of this entire process? Make a mistake in my assumptions?

Please be my sounding board.

----

Edit: since this post, I discovered that buying the car before the end of the lease leads to substantial savings. Combining one-pay lease, the $7.5k credit and buying the car 3 months into the lease results in the car costing less than buying it upfront.

More details here!

I always based my stance on the interests paid over the course of the lease but then came across the one-pay option.

Coupling that with a short lease can actually make sense (to my very “anti-lease” self).

Context:

- My goal was always to buy the car and keep it until the warranty runs out - so 4 years.

If I loved it I could buy a warranty extension, but I suspect the EV landscape will be quite different by then and I‘ll want something else. - I have been drooling over the Macan before it was even announced: there is no other car on the market that competes with it, I am *not* looking for the next car already.

- I had a Mustang Mach-e prior, bought it outright, sold it 19 months later and took a bath: got half of what I paid. The market isn’t kind to EV and tech is evolving.

- My concerns about the Macan specifically are: it’s a first gen Macan electric and one of the (relatively) first ones to be sold… it could have issues that would make me not want to keep it.

The options:

I asked my SA to share all options with me and I’ve summarized the costs and options in the charts below.

Couple notes on the math:

- Investing the unspent money over the next 12/18/24/39 months with a 4% return, it can offset in part the cost of leasing.

That 4% can easily be secured with a CD but I could probably earn more through stocks - I’m being conservative here. - The sales tax on EV in NJ is changing through the ownership of my Macan: if I buy the car now, I’ll only pay 3.3125% in taxes… but if I buy it after the lease ends, I’ll pay 6.625% on the balance. ?

- All the leasing options include the $7.5k tax credit which may very well vanish next year if Trump follows through. So it may be worth squeezing it now.

My thoughts:

- With the 12 mo option, I could buy the car (with the increased sales tax) at lease end and be out of pocket less than $600 vs direct purchase. Not bad at all!

- Both the 18 and 24 mo offer similar peace of mind but at an increased premium… I need to check what the 24mo option would cost with 10k miles/yr.

- The 39 mo option gives the most use of the car but buying at the end of that lease makes no sense.

- The question is: if I instead bought the car upfront and sold it after 39 mo, could I get at least $42k out of it? (36% residual when Porsche states residual will be 55%) If not, leasing may also work in my favor.

If conditions are favorable, I can just buy it then - and still sell it after 39 (or x) months of ownership when something better comes along.

If conditions suck, I can just walk away after 18/24 months.

Did I miss something? Not consider any aspect of this entire process? Make a mistake in my assumptions?

Please be my sounding board.

----

Edit: since this post, I discovered that buying the car before the end of the lease leads to substantial savings. Combining one-pay lease, the $7.5k credit and buying the car 3 months into the lease results in the car costing less than buying it upfront.

More details here!

Sponsored

Last edited: